On this page:

- Was Unsecured loans Handled as Taxable Income?

- Is actually good Forgiven Unsecured loan Considered Nonexempt Income?

- Is Personal loans Tax deductible?

- Prepare for Taxation Time Throughout every season

You generally won’t need to spend income taxes for the your own loan for people who pay-off the loan entirely. You may need to if the bank forgives a portion of the loan or you settle the remainder of your debt for cheap than simply you borrowed. If it goes, this new piece it’s not necessary to pay-off tends to be used in your taxable earnings towards the season.

Try Unsecured loans Handled once the Taxable Earnings?

Unsecured loans essentially aren’t taxable as money you receive actually income. In lieu of earnings otherwise financing income, that you earn and continue maintaining, you will want to repay the money your obtain.

Since they are perhaps not an income source, it’s not necessary to statement the private money you’re taking away on the income tax get back. This really is true if a financial, borrowing from the bank connection, peer-to-peer financial or other lender borrowed the currency.

For many who receive a personal loan of a pal or family unit members affiliate, there may be almost every other income tax implications, but the money nevertheless won’t be nonexempt money for your requirements. Such as, should your loan does not have any notice or a below-market rate of interest, just like the dependent on the present day “appropriate federal rate,” this new Irs could possibly get consider this a gift in place of a loan.

When something special is actually for more than the fresh new provide income tax different towards season-$fifteen,000 into the 2020-the one who will provide you with the bucks may have to file an extra form (Internal revenue service Form 709). However,, even then, you don’t have to report searching the present. And, the new gift giver wouldn’t shell out one gift taxes unless they will have offered aside more the fresh existence provide tax exemption-which was $ million since 2020.

Is actually a Forgiven Unsecured loan Noticed Nonexempt Earnings?

Since a borrower, you may need to spend income tax on a fraction of a personal bank loan that is canceled, forgiven otherwise released.

Such as for example, for those who have good $2,500 a good harmony with the a consumer loan therefore the creditor believes to repay new make up $step 1,500, then you will enjoys $step 1,100 in terminated loans. Brand new canceled loans represents earnings, in the event a portion of the terminated financial obligation is comprised of costs and passions. The financial institution will also deliver additionally the Internal revenue service a form 1099-C you need to help prepare and you can file your taxation return.

You could finish which have the same condition along with other items off personal debt as well. With some federal education loan repayment preparations, your own leftover student loan obligations could well be forgiven once you make payments to possess 20 so you can twenty five years, on forgiven matter sensed taxable earnings.

However, there are also exclusions. Good forgiven unsecured loan doesn’t trigger taxable income when the, eg, your debt try released during personal bankruptcy. Or, while insolvent (your debt extra money than your existing possessions) if the loans try forgiven, upcoming region otherwise all forgiven debt might possibly be excluded from your gross income. Certain education loan forgiveness apps and additionally end up in debt forgiveness instead of taxation consequences.

Was Signature loans Tax-deductible?

You simply cannot subtract the attention you only pay on your personal loan if you do not utilize the money for many particular explanations and you will meet the associated qualification standards.

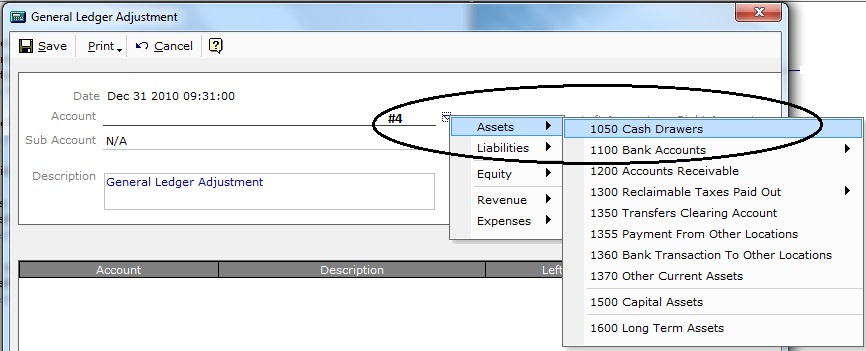

You’re when you use specific or all of the money to own a business debts. You ount of great interest repayments out of your organization income. However, ensure that the financial allows you to sign up for an effective financing for team have fun with (some would, other people don’t), and sustain facts out-of the method that you spend the money.

Another exception might possibly be by using out a personal bank loan and use all money to fund qualified educational costs on your own, a girlfriend or a depending. Or, for folks who re-finance an educatonal loan which have an unsecured loan. In these cases, you can be considered to deduct up to $2,five-hundred from inside the focus repayments a-year.

But once again, talk to the lending company to find out if this has personal loans to possess instructional costs, and compare unsecured loan offers to real college loans. We pull out student loans because they bring down attention costs and tend to be eligible for special forgiveness and you may repayment apps.

There is an enthusiastic itemized deduction for investment notice for many who use money buying investments that are not tax-exempt. Such as, by taking out that loan to find brings, you will be capable subtract the new loan’s desire. You could just deduct around the degree of resource money you had toward season, you could roll over a lot more wide variety to help you offset future years’ capital money.

Plan Income tax Day Year round

While you may only document one yearly income tax get back, tax believe try a year-round process. Part of this requires knowing how their procedures increases your own taxable income and you may associated tax bill, otherwise cause deductions that can lower your taxable earnings and money. Signature loans basically don’t play a massive part from inside the taxation believe, as the taking out and paying down a loan fundamentally would not impression your own taxes. Nevertheless, continue exclusions at heart, particularly when one of the bills is actually forgiven otherwise released.

What makes good credit?

Discover what it takes to get to good credit. Comment your FICO Get off Experian today at no cost to discover what is providing and hurting your own https://clickcashadvance.com/loans/student-loans-without-co-signer/ score.